EPCG stands for Export Promotion Capital Goods.

The objective of this scheme is to facilitate the import of capital goods to produce quality goods and services to enhance India’s export competitiveness.

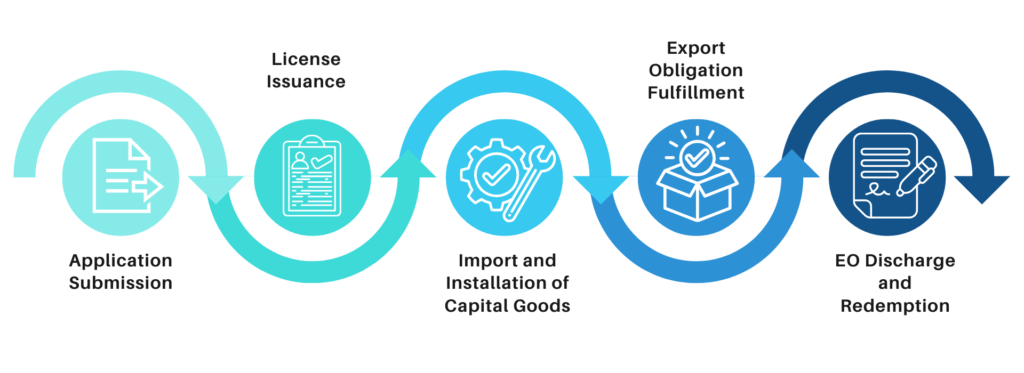

EPCG scheme allows the import of capital goods for pre-production, production and post-production at zero customs duty.

To import duty-free (by not paying Customs Duty, Cess, ADD etc., duties) Capital Goods and Spare Parts and to manufacture quality Export Products.

Manufacturer Exporters and Merchant exporters are tied to supporting manufacturers and Service Providers.

The validity to import Capital goods under the EPCG scheme is 24 months i.e., 2 years from the EPCG date. There is no revalidation (extension of the time limit) available for imports.

An installation certificate is a proof of installation of capital goods at the said factory of the license holder, obtained from the jurisdictional Customs Authority or an independent Chartered Engineer.

Submit the Installation Certificate within six months from the date of import. However, in the case of importing spares, submit the installation certificate within three years from the date of import.

The export validity period is 6 years from the date as detailed below. There is an extension in the time limit for fulfilling exports. The exporter may choose to obtain either a one-year or two-year extension or increase the Export obligation by 10% or 20%. Overall, 6 years + 2 years, i.e., 8 years is available for fulfilling EO.

Exporters fulfill the export obligation under the EPCG scheme by exporting goods/services. The export obligation may be fulfilled through physical exports, SEZ Exports as well as deemed exports. The EPCG authorization holder can either export directly or through a third party exporter.

The authorization/license holder is obligated to complete two types of export obligation. Specifically, They are:

In this case, the company must fulfill a specific export obligation calculated as six times the duty saved value/amount within 6 years. Furthermore, these obligations are divided into 2 blocks: the first block and the second block.

To meet this requirement, fulfill the export obligation as follows: first, fulfill a minimum of 50% in the First block (i.e., the first 4 years from the EPCG date) and fulfill the remaining 50% in the Second block (i.e., next 2 years from the expiry of the first block date).

Next, calculate the annual average Export Obligation as the average export performance for the same and similar products in the previous three years, Consequently, this must fulfill each year until SEO fulfillment.

Moreover, the DGFT issues the Export Obligation Discharge Certificate upon completion/fulfillment of Export Obligation. After receiving the EOD Certificate, a license holder can then approach Customs to cancel the Bond and release the Bank Guarantee.

In addition, In case of non-fulfilment of Export Obligation within the EO period, the EPCG license holder shall pay Customs Duty along with applicable Interest to the Customs Authority.

Export Promotion Capital Goods (EPCG) scheme is to facilitate the import of capital goods with the purpose of producing quality goods and services to enhance India’s export competitiveness. EPCG scheme allows import of capital goods for pre-production, production and post-production at zero customs duty.

There are two types of Export Obligation.

The First Block period is for the first four years from the date of allocation of the authorisation.

The Second Block period is for the two years from the date of allocation of the authorisation.

The Export Obligation period under EPCG is Six years from the date of authorisation.

Once the Export Obligation is fulfilled, you may sell the Capital Goods.

The average export performance achieved in the antedating 3 licensing years for the same and similar products. And it will be fixed on the EPCG license while its issuance by taking the average of preceding three years of export turnover.

Exemption from the maintenance of annual Average Export Obligation may be provided.

Yes, Third-party Exports will be counted for Export Obligation fulfilment.

An installation certificate under the Export Promotion Capital Goods (EPCG) Scheme is a document that confirms that imported capital goods have been installed at a plant and are being used for production.

EPCG authorisation shall be valid for imports for 24 months from the date of allocation of the authorisation